WHAT ARE FINANCIAL DIAMONDS

Typically speaking of the certificate issued by the Gemological International Institute (IGI) or similar certificate issued by the High Council for Diamonds (HRD). Both institutions have their headquarters in Antwerp, Belgium.

Other world renowned certifications are Gemmological Institute of America GIA (USA), l’AGS (American) e l’EGL (European Union)

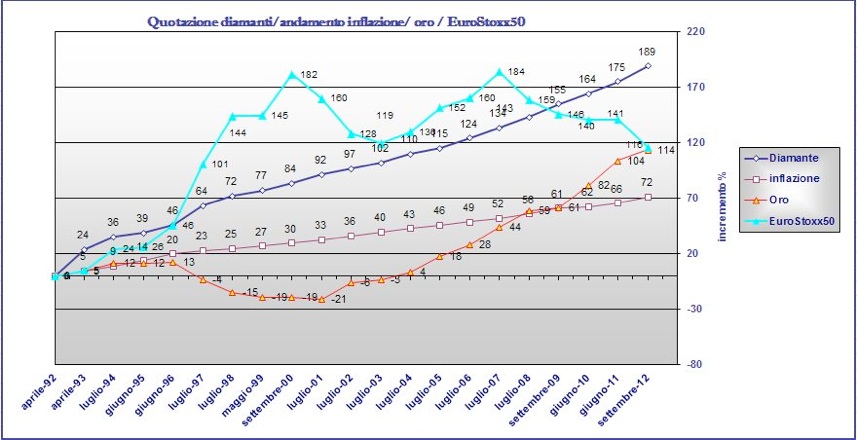

HISTORICAL QUOTES

You can compare the progress of gold, inflation and the price of diamonds and draw your own considerations. However, as we are trying to analyze with brokers who join in the discussion, we must consider the costs associated with the purchase (which cannot be resolved with intermediation only, but continue with the costs of any policies and / or safe) and resale.

HOW MUCH TO INVEST

As a safe haven, the financial diamond can be an alternative to diversify portfolios since it is possible to buy it anywhere and it would seem as easy to resell especially for amounts ranging between 2-4 thousand euro (or perhaps it would be better to speak about stones from 0.5 carats).

The idea is then to allocate a percentage of our own portfolio (5-20%) and buy diamonds which would be worth around € 2,000 each at most. It is in fact not recommended to buy such diamonds that individually could be worth € 30,000 given the difficulties that would find for the subsequent replacement.

It is also due to consider the high volatility of the asset and is therefore good to see it as a long term investment (at least 1-2 years, but also longer periods of 7-10 years).

PURCHASE ASSISTANCE

We are studying an investment project customized to the target and on budget. We offer our expertise for a guide to find the budget itself, proportioning it to our own investment portfolio.

INVEST IN DIAMONDS

.

Copyright @ 2012 Cerra Preziosi s.r.l. - Diamonds and Fine Jewellery Wholesaler’ s - P.IVA 03072610102 - Piazza Soziglia, 1/3A 16123 Genova Italia